The money ratio is an much more stringent measure of liquidity as it considers cash and marketable securities solely. It shows whether or not the company has readily available cash and marketable securities to pay for its current liabilities. Key solvency ratios are the debt-to-equity Ratio and interest coverage ratio. A high https://www.kelleysbookkeeping.com/ debt-to-equity ratio signifies the brokerage has a risky quantity of debt relative to its fairness capital. The curiosity coverage ratio measures how easily a brokerage service receives its curiosity costs from working earnings. Together, these various ratios present a more complete image of a company’s monetary position and working efficiency when evaluating its stock as an investment.

B High Quality Of Belongings

Present liabilities include accounts payable, wages payable, and the present portion of any scheduled interest or principal fee. Understanding liquidity ratios empowers stakeholders to navigate uncertainties, mitigate risks, and capitalize on alternatives. From assessing short-term solvency to optimizing working capital administration, liquidity ratios present actionable intelligence for strategic decision-making.

The excellent businesses control liquidity carefully to keep away from shortfalls. A excessive cash ratio could indicate that management can’t make the most of the business’s money and struggles to find funding and growth alternatives. And a cash ratio below 1 is not necessarily dangerous news—especially if the agency has quick credit score terms with purchasers, environment friendly inventory management, and a brief net commerce cycle.

In times of market volatility, like crashes or bubbles, many purchasers need to sell securities urgently and withdraw funds rapidly. Another limitation is that the liquidity ratio focuses narrowly on money and liquid belongings. Nevertheless, holding high levels of low-yielding money will drag on firm returns.

Example: Debt-to-assets

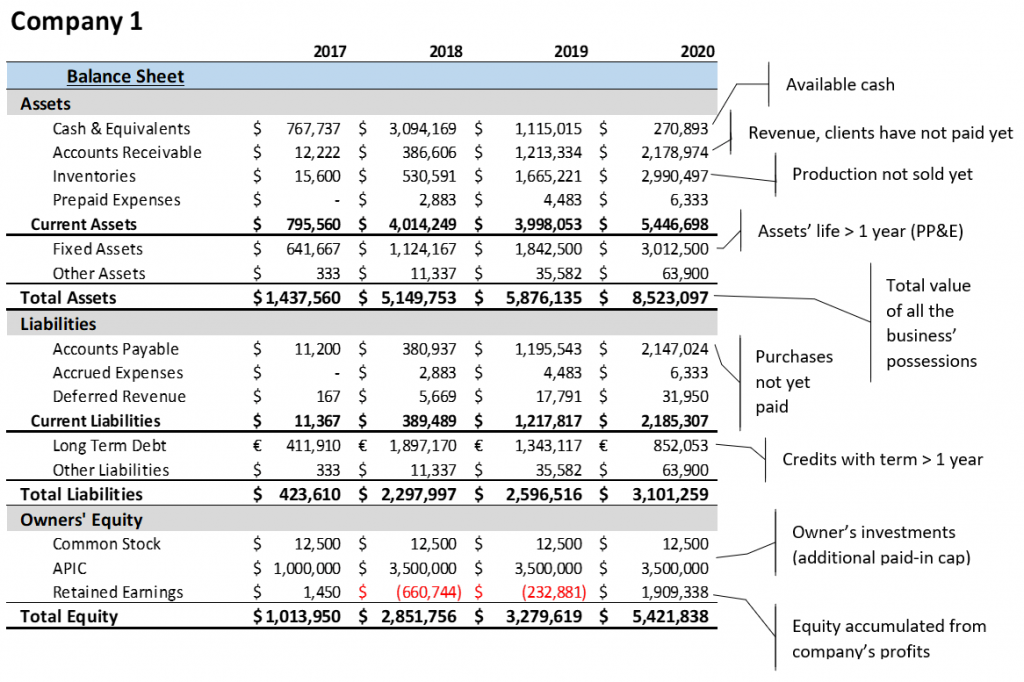

Evaluate ratios across a number of quarters or years to identify patterns. For example, suppose a country has 1,000,000 lively obligation navy personnel and a total land space of three,000,000 sq. kilometers; its primary defense ratio could be as given under. Present property are all of the assets that a company expects to convert into cash or burn up within one year. Liquidity ratio analysis is also less effective for comparing businesses of different sizes in numerous geographical areas. Liquidity ratio evaluation will not be as efficient when trying throughout industries, as various businesses require different financing structures. Investors often choose a lower P/E because they’d need to spend much less money for every dollar of earnings.

Working Capital Turnover Ratio

- Liquidity ratios use probabilities to reveal if a industrial enterprise will pay off debts once they fall due.

- A larger present ratio signifies larger liquidity and a lower threat of economic distress.

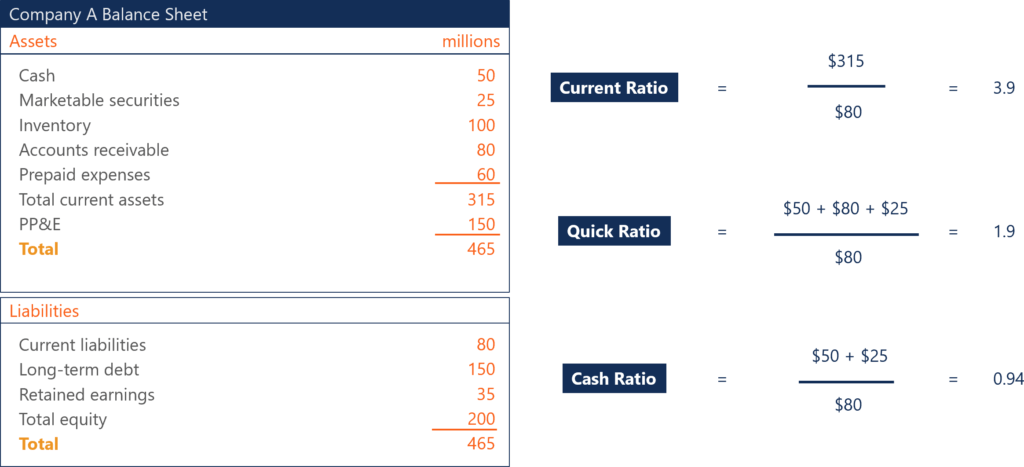

- There are many forms of liquidity ratios, but crucial ones are the current ratio, fast ratio, and cash ratio.

- Buyers use the liquidity index to evaluate how correctly an organization can manage monetary pressure.

- Liquidity helps avoid the danger of a financial establishment run, during which depositors pull out money fast.

This indicates a strong liquidity position, as the corporate has ample money reserves to cowl its short-term obligations. This indicates that Firm ABC has $2 in present assets for each dollar of present liabilities. With a present ratio of 2, the corporate what are the liquidity ratios has a wholesome liquidity place, suggesting that it could easily cowl its short-term obligations.

Pablo is the proprietor of Fresh Baked, an organization that operates 12 bakeries in Ny and founded in 1983 by Pablo’s father. The current ratio is a standard liquidity ratio used to judge whether or not or not an organization will pay present obligations. Firms can usually manage these sorts of money circulate problems with short-term debt. The present ratio is equal to current belongings divided by present liabilities.

Corporations and banks want to reveal liquidity ratios frequently to avoid money shortages. Buyers and creditors moreover watch these ratios to decide if a corporation or bank is strong. Good liquidity control continues a business or bank safe from surprising charges or risks.